Unfortunately, HOA insurance policies and filing claims can be difficult to navigate if you are unfamiliar with the process. It takes time and expertise to follow the complexities that arise after filing a property damage insurance claim for community property.

If you are a property manager, HOA president, new to an association board, or a resident interested in learning more about your association’s master insurance policy, there are a few important questions to ask while reviewing coverage. Here are our recommended questions to ask about your HOA’s master policy and why.

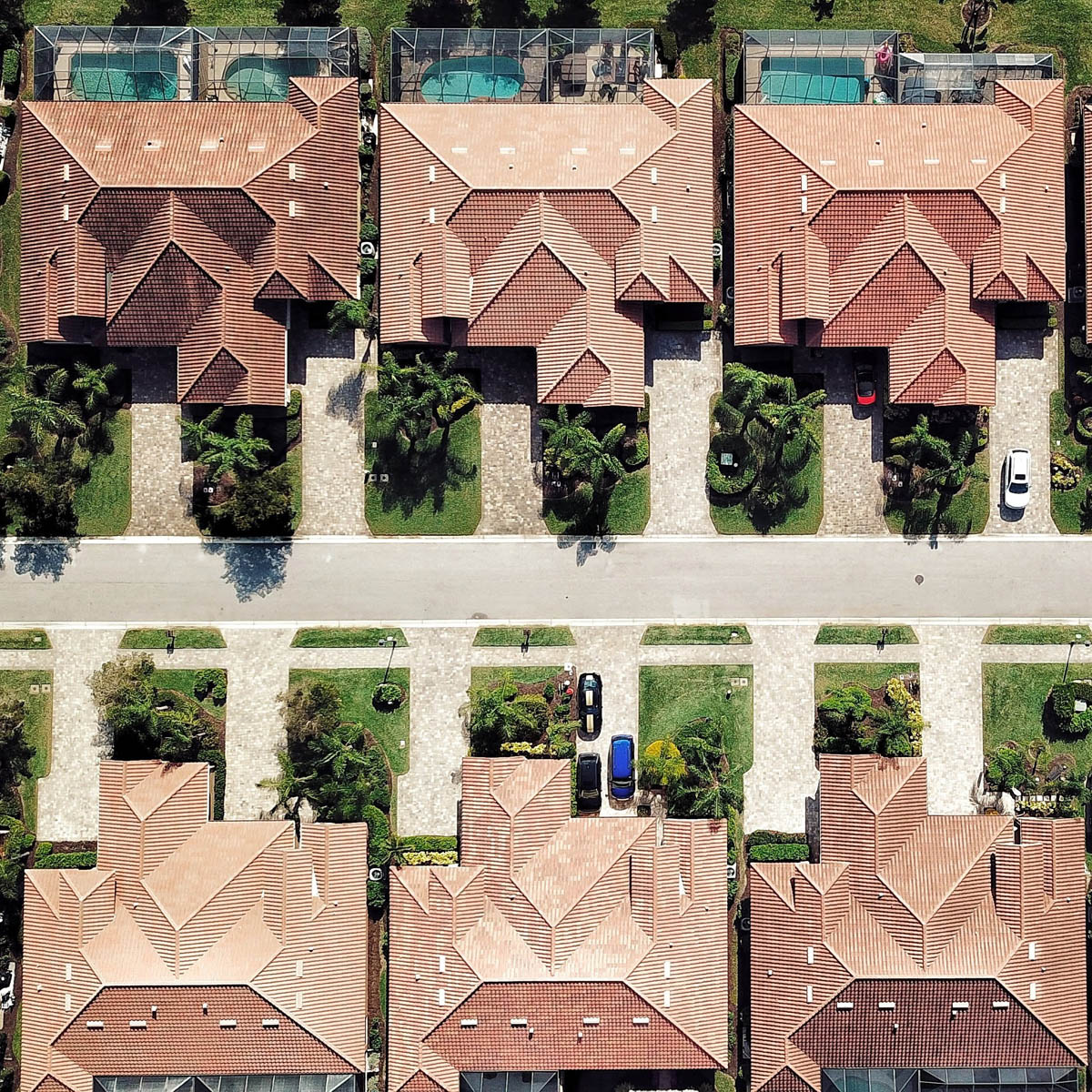

- What kind of master insurance does your HOA have? “Studs-out coverage” is the most common type of coverage for an association. It covers everything outside of an owner’s unit, such as common areas, gyms, pools, parking lots, roofing, and siding. Each resident’s homeowners insurance policy or renters policy would cover damage inside the unit.

- What are the community’s common areas and shared responsibilities? The master policy is designed to protect the community’s common areas similar to how a homeowners policy would protect a home. Understand what common areas within your community are covered under the policy so that it is clear who is responsible for repairs when damage occurs.

- Are the HOA governing documents clear on HOA duties to unitholders regarding the insurance policy? The HOA’s insurance coverage should be clear to property owners within the community to mitigate disputes when damage occurs.

- What types of losses are covered under the master policy? Every master policy will provide liability protection and property coverage for common areas and external structures. Depending on your community and the risk of certain natural disasters in your area, specific coverage may differ from policy to policy.

- What would be the cost to rebuild common areas if damaged in a natural disaster? Does the policy cover this cost? Make sure your community is paying for a policy that is large enough to cover the cost to rebuild the shared property, if necessary.

When a community insurance claim is not handled correctly, it could create legal risks for directors, property managers, and others involved for breach of fiduciary duty or other duties under state statutes or the community’s governing documents.

If you are having trouble filing or navigating a community or condo association claim, our team can help. Our firm works with homeowners association directors, property managers, and their current attorneys to guide the HOA through the claims process. Let the team at Vishio Forry help your community if you have suffered property damage or loss. Call us for a free consultation at (239) 703-7210 or contact us online.